- Why IT Asset Recovery Matters in 2026

- What Is IT Asset Recovery?

- Why Most Organizations Lose Value on Retired Hardware

- How IT Asset Recovery Generates Revenue

- IT Asset Recovery ROI Framework

- Device-by-Device Value Benchmark Table

- The Business-Wide Payoff of Effective Asset Recovery

- Step-by-Step: How to Monetize Retired IT Assets

- Common Mistakes That Reduce Asset Recovery Value

- Case Studies: How Leading Companies Monetize Retired Hardware

- FAQs

Why IT Asset Recovery Matters in 2026

Retired hardware represents one of the most overlooked budget offsets in IT. When asset recovery is executed correctly, it returns 10–30% of lifecycle value, strengthens data security, and reduces compliance liabilities.

The rapid expansion of hybrid work, cloud migrations, and instances of small business restructuring have dramatically increased the volume of corporate IT equipment hitting end-of-life, creating a unique opportunity for organizations to reclaim lost capital.

- More laptops per user

- Shorter refresh windows

- Faster performance obsolescence

- Increased data privacy regulations

- Higher raw material value in metals

- Stronger demand in secondary IT markets

Despite this, most organizations still treat retired hardware as e-waste, not a revenue opportunity.

Industry-wide, companies collectively forfeit millions each year through:

- Delayed decommissioning

- Storing hardware “until later”

- Losing chain-of-custody visibility

- Using non-certified recyclers

- Underestimating residual value

- Poor lease-return management

This guide fixes that.

What Is IT Asset Recovery?

A structured, secure, and value-focused process for determining what retired IT equipment is worth, selecting the best disposition path (resale, refurb, parts harvesting, or certified recycling), and maintaining full chain-of-custody from pickup to final disposition.

How IT Asset Recovery Fits Within ITAD

ITAD (IT Asset Disposition) is the umbrella process. Asset recovery is the revenue-generating portion inside ITAD.

Key Terms for IT Asset Recovery

ITAD:

A managed process overseeing secure data sanitization, logistics, remarketing, recycling, and reporting.

Residual Value:

The actual secondary-market price of a device today based on age, condition, and demand.

Chain of Custody:

A documented record showing where each device has been from pickup to final disposition.

Secondary IT Market:

Where used business-grade laptops, servers, networking gear, and mobile devices are traded.

Circular Economy:

Keeping devices and materials in use longer to reduce waste and improve lifecycle efficiency.

IT Asset Recovery:

Identifying a device’s remaining value and directing it into the most suitable recovery route.

Value Recovery Channels:

The practical routes available for outgoing equipment, including resale, refurbishment, trade-in programmes, and certified recycling, each supported by established operational processes.

Circular Economy:

Keeping devices and materials in use for as long as possible, reducing waste, and extending the life of technology.

R2v3:

The latest version of the Responsible Recycling Standard, developed by Sustainable Electronics Recycling International (SERI).

Why Most Organizations Lose Value on Retired Hardware

The top three reasons companies lose 40–60% of recoverable value are: (1) delayed processing, (2) missing documentation, and (3) lack of market-aligned resale channels.

The Value Leak Pattern

When companies fail to recover value, the cause usually traces back to four errors:

- Devices sit in storage too long

Laptops lose 2–4% of resale value per month after year four.

- Residual value is never assessed

Without benchmarking, organizations unknowingly recycle hardware that still holds value.

- Data security concerns delay movement

Devices get stuck in “compliance limbo.”

- Wrong partners or wrong channels

Many recyclers are not equipped to maximize resale pricing.

Hummingbird sees this pattern across organizations of every size, from 50-seat offices to multi-campus enterprises. The good news: these problems are simple to fix with a structured, repeatable recovery process. Do you want to bring the same clarity to your own asset lifecycle? Reach out to our team today!

How IT Asset Recovery Generates Revenue

There are four primary revenue engines for IT asset recovery: resale, parts harvesting, precious-metal recovery, and optimized lease returns.

Did you know, the global ITAD market is projected to grow from $18.4 billion in 2024 to $26.6 billion by 2029, with a CAGR of 7.6%. With these numbers in mind, let’s break down the main sources organizations rely on. Think of these as the revenue engines behind any mature recovery program.

1. Resale of Working Devices (Highest ROI)

Resale delivers the largest returns—especially for 3–4-year-old business-grade laptops, workstations, servers, and networking gear.

Resale is the most profitable channel because:

- Business-grade devices are durable

- Corporate refresh cycles maintain a predictable condition

- Secondary markets demand certified, tested equipment

- Laptops and servers with SSDs retain higher value

Typical Resale Ranges (General Benchmarks):

| Asset Type | Common Age | Typical Resale Range |

| Business Laptops | 3–4 years | $120–$450 |

| Workstations | 5–6 years | $400–$800+ |

| Enterprise Servers | 5–7 years | $500–$1,000+ |

| Networking Gear | 4–6 years | $60–$300 |

2. Parts Harvesting (Value for Non-Resellable Units)

When a device can’t be sold whole, its components may still hold strong value.

High-value components include:

- SSDs

- RAM modules

- GPUs

- Server blades

- Power supplies

- Screens

Parts harvesting supports both resale markets and internal maintenance budgets. Organizations routinely reduce spare-part procurement spend by 20–30% through strategic harvesting.

3. Precious Metals & Raw Materials Recovery

End-of-life devices still contain gold, copper, palladium, and aluminum. While returns are smaller, scale makes this profitable.

This path becomes especially valuable during:

- Data center decommissions

- Network refreshes

- Telecom equipment retirement

- Government/education batch recycling

Precious-metal recovery offsets disposal costs and ensures environmentally responsible processing.

4. Optimized Lease Returns

Well-managed lease returns prevent penalty charges and can earn credits toward future deployments.

Organizations lose money on leased assets when:

- Devices are returned late

- Data wiping isn’t documented

- Condition grading is poor

- Batteries or drives are missing

With a structured process, companies often reduce lease-return penalties by 40–70% and generate credits that feed directly into future refresh cycles.

IT Asset Recovery ROI Framework

If you want to turn end-of-life hardware into meaningful recovery value, you need a proper framework. Below are five factors that are the real drivers of how much money you’ll get back.

1. Age (The #1 Predictor of Recovery Value)

Devices retired within 3–4 years retain the strongest resale value; after year four, depreciation accelerates sharply.

Typical recovery by age:

- 3 years → ~28% value return

- 4 years → ~18% return

- 5 years → ~12% return

Delaying retirement to year 6–7 pushes nearly all devices into parts-only or scrap categories.

The Cascade ITAD benchmarking report shows the average age of retired laptops is around 4.8 years.

2. Specification (Higher Specs = Higher Value)

Performance hardware—workstations, servers, and premium laptops—holds significantly higher value.

Examples:

- Servers and workstations recover 40–70% of residual value

- Refurb laptop values rose 16% YoY, driven by hybrid-work demand

- SSD-based systems consistently outperform HDD equivalents

- Specifications matter almost as much as age

3. Condition (Cosmetic Grade = Price Multiplier)

Cosmetic grade is one of the strongest value multipliers.

Price differences:

- Grade A devices sell for 20–40% more

- Healthy batteries add 10–15% to the resale price

- Missing drives or RAM reduces resale by 20–50%

Condition is highly controllable—good storage, early pickup, and proper handling preserve value. “Grade A” laptops typically sell for 20–40% more than equivalent models in lower cosmetic grades.

4. Volume (Consistency Strengthens Pricing)

Batches of similar devices command higher resale rates.

Consistent volume:

- Increases average rebates by ~30%

- Reduces processing costs

- Improves buyer confidence

- Allows advance market commitments

Large buyers prefer predictable, standardized shipments. According to recent resale-market reporting, consistent volume can raise average rebate returns by nearly 30%.

5. Timing (Release to Market Matters)

Market timing affects value; moving equipment quickly preserves price.

Resale and remarketing represent 37.6% of the entire ITAD market, showing how timing drives value.

Organizations that align:

- Lease returns

- Refresh cycles

- Tax windows

- End-of-year procurement schedules

…consistently generate higher returns.

Understanding and actively managing them helps CFOs and procurement teams with corporate refresh cycles and makes smarter recovery decisions.

Resale and remarketing account for about 37.6% of the entire ITAD market, showing how strongly timing and demand influence overall recovery potential.

Device-by-Device Value Benchmark Table

To help you understand better, here’s a breakdown of different types of corporate/enterprise devices, their likely age when retired, and what kind of resale range you might realistically see, based on secondary market data and ITAD benchmarks.

| Device | Average Age at Retirement | Typical Resale Range |

| Dell Latitude 7490 (business laptop) | 4 years | US $120 – $230 (based on off-lease laptop market) |

| HP EliteBook 840 G5 | 4.5 years | US $150 – $260 (condition dependent, business grade) |

| Lenovo ThinkPad T480 | 5 years | US $130 – $250 (popular model in corporate off-lease market) |

| Dell Precision 5820 workstation | 6 years | US $400 – $800+ (workstations retain value better due to specs) |

| HPE ProLiant DL360 Gen9 server | 6 years | US $500 – $1,000 (used 1U servers often go for this range) |

| Cisco Catalyst 2960 switch | 5 years | US $60 – $200+ depending on port count and condition |

By tracking and optimizing these five levers, you can make your IT asset recovery far more predictable. Instead of hoping for a “good deal,” you can engineer value.

The Business-Wide Payoff of Effective Asset Recovery

Different departments benefit differently from asset recovery.

For CFOs

- Predictable recovery revenue

- Lower total cost of ownership

- Improved refresh-cycle budgeting

- Reduced storage and disposal costs

For ITAM Managers

- Complete lifecycle visibility

- Reduced audit and compliance exposure

- Fewer orphaned assets

- Clear, documented chain-of-custody

For Procurement

- Recovery revenue offsets new purchases

- Improved pricing leverage

- Fewer late lease-return fees

- Real-world valuation data for planning

For Sustainability / ESG Leaders

- Compliant recycling

- Measurable circular-economy metrics

- Reduced environmental impact

- Stronger sustainability reporting

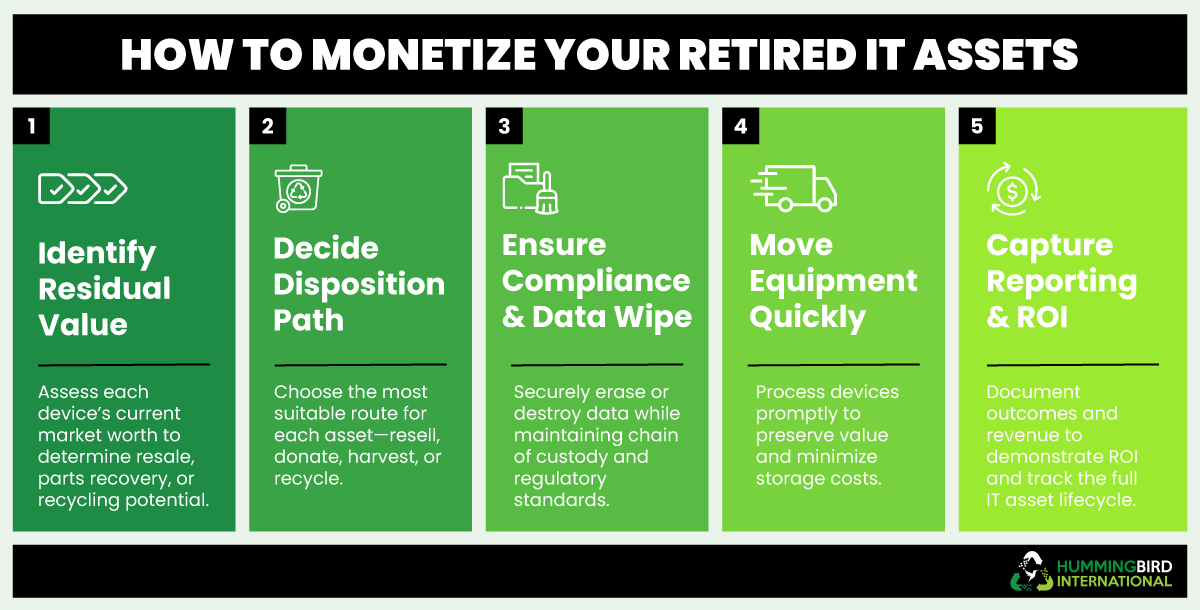

Step-by-Step: How to Monetize Retired IT Assets

Below is the structured five-step process that consistently generates maximum recovery value.

Step 1: Identify Residual Value

Accurate valuation determines the highest-yield path—resale, parts harvesting, donation, or recycling.

Residual value assessment includes:

- Make/model

- Age

- Specs

- Condition

- Market demand

Skipping this step leads to lost revenue and premature recycling.

Step 2: Decide the Disposition Path

Match each device to the highest-value, compliant channel.

Common paths:

- Resale: Good condition, high demand

- Refurbishment: Minor repairs needed

- Parts Harvesting: Internal reuse or resale

- Donation: ESG-positive options

- Certified Recycling: For end-of-life devices

Step 3: Ensure Compliance & Data Wiping

Data security is non-negotiable. Every device must be wiped, destroyed, or sanitized to NIST 800-88 or equivalent standards.

Processes include:

- Serialized chain-of-custody

- Blancco or DoD-compliant wiping

- Secure transport

- On-site destruction for high-risk drives

Step 4: Move Equipment Quickly

Speed preserves value. Devices lose value the longer they sit in storage.

Typical value loss after year 4:

- 2–4% per month

- Market declines during new-model launches

- Battery degradation

- Cosmetic wear

Fast logistics = preserved value.

Step 5: Capture Reporting & ROI

Reporting closes the loop, proving data sanitization, recycling compliance, and financial return.

Reporting includes:

- Serialized audit

- Resale values

- Component recovery

- Destruction certificates

- ESG metrics

Common Mistakes That Reduce Asset Recovery Value

These five pitfalls account for nearly all value loss.

- Poor inventory management

- Waiting too long to decommission hardware

- Inadequate data-wiping documentation

- Using the wrong resale/recycling channels

- Ignoring compliance requirements

Avoiding these errors can double the recovery value.

Comparison Table: Traditional Disposal vs Asset Recovery

| Category | Traditional Disposal | Structured Asset Recovery |

| Residual Value | Lost | Recovered (10–30%) |

| Data Protection | Limited | Full chain-of-custody |

| Compliance | Risky | Documented & auditable |

| ESG Impact | Negative | Positive (reuse/recycle) |

| Cost | Cost center | Revenue generator |

Case Studies: How Leading Companies Monetize Retired Hardware

Many leading companies have discovered that sustainability and profitability aren’t mutually exclusive. By adopting structured IT asset recovery and responsible e-waste practices, they’ve achieved measurable business outcomes—cost offsets, revenue recovery, and risk mitigation.

Let’s take a closer look at the companies that adopted “green” so successfully that sustainability is now an essential part of their business operations!

-

Microsoft: Turning Cloud Hardware into Circular Value

Microsoft is a global technology company that develops software, cloud services, and hardware. It operates one of the world’s largest cloud infrastructures, serving millions of customers worldwide, and is known for integrating sustainability into its operations and managing large-scale IT assets across data centers and enterprise solutions.

Business Challenge

With rapid growth in cloud demand, Microsoft faced a rising tide of end‑of‑life servers and networking gear. Discarding this hardware meant increasing e‑waste, losing residual value, and environmental burden.

The Solution

Microsoft launched a dedicated programme called Microsoft Circular Centers. In these facilities, decommissioned servers and hardware are routed for assessment, disassembly, testing, and either internal reuse, resale, component harvesting, donation for training‑use, or responsible recycling. By sorting components, refurbishing viable parts, and reclaiming materials from end‑of-life gear, the Circular Centers convert obsolete equipment into usable resources.

Results

Microsoft’s Circular Centers have transformed retired hardware into a consistent source of value. By 2024, the company achieved a 90.9 % reuse and recycling rate, hitting its 2025 target a full year early. Over 3.2 million parts were recovered for reuse, resale, or donation, reducing new hardware spending and supporting educational and community programs.

-

Cisco: Maximizing Value from Networking Hardware

Cisco is a leading provider of networking and communications technology, offering routers, switches, and enterprise solutions to businesses and service providers worldwide. The company designs, sells, and supports hardware and software that connect people, devices, and networks, maintaining a strong focus on innovation and operational efficiency.

Business Challenge

With frequent hardware upgrades across its client base, Cisco faced large volumes of retired networking gear. The challenge was to recover value from these assets while maintaining strict data security and environmental compliance.

The Solution

Cisco developed its Takeback and Reuse program to collect end-of-life switches, routers, servers, and accessories. Equipment that met performance standards was refurbished and sold through Cisco Refresh, the company’s certified remanufactured product line. Non-reusable items were disassembled for parts or processed through certified recycling partners, ensuring valuable materials remained in circulation.

Results

The program enabled Cisco to extend the life of its hardware, reduce waste, and generate secondary revenue streams. Thousands of devices were refurbished and resold, providing cost-effective enterprise solutions to customers while reclaiming metals and plastics from items that could not be reused.

-

Dell: Driving Reuse and Circularity in IT Hardware

Dell Technologies is a global computer technology company that develops, sells, and supports laptops, desktops, servers, and peripherals for businesses and consumers. The company emphasizes sustainability and efficiency, and manages large volumes of corporate hardware while integrating circular practices into product design and IT asset lifecycle management.

Business Challenge

Dell needed a way to handle increasing volumes of retired corporate laptops, desktops, and peripherals without generating unnecessary waste. The company aimed to recover value from decommissioned devices, reduce procurement costs, and ensure responsible environmental practices across its operations.

The Solution

Dell implemented its long-running “No Computer Should Go to Waste” program. Devices are collected from corporate clients, tested, refurbished, or disassembled for parts. Reusable equipment enters secondary markets, while materials like plastics and metals are reclaimed for use in new products through a closed-loop initiative.

Results

The program allows Dell to recapture value from retired assets, reduce material costs, and maintain a high level of environmental responsibility. Hundreds of thousands of devices have been refurbished or recycled to date, extending product lifecycles and supporting circular-economy goals.

-

Amazon Web Services (AWS): Extending Data Center Hardware Life

Amazon Web Services (AWS) is a leading cloud services provider that offers computing power, storage, and networking solutions to businesses and developers globally. Operating thousands of servers across multiple regions, AWS emphasizes operational efficiency, scalability, and sustainability in managing its extensive data center infrastructure.

Business Challenge

AWS faced large volumes of retired servers and storage hardware that could no longer meet performance standards. So, the challenge was to recover value from this equipment, minimize waste, and ensure secure handling of sensitive data across multiple locations.

The Solution

AWS implemented a server repurposing program where each unit undergoes testing, repairs if needed, and certified data sanitization. Functional servers enter the Amazon Renewed marketplace, while components from non-functional hardware are harvested, and the remaining materials are responsibly recycled. This approach maximizes reuse while maintaining compliance and environmental responsibility.

Results

The initiative enabled AWS to recover financial value from otherwise idle equipment, reduce new hardware purchases, and maintain high sustainability standards. Thousands of servers have been refurbished or repurposed, contributing to operational savings and a smaller environmental footprint.

-

AT&T: Optimizing Value from Network and Mobile Devices

AT&T is a multinational telecommunications provider delivering mobile, broadband, and enterprise networking services. With a vast array of network equipment and business devices, the company balances large-scale operations with technology refresh cycles and sustainability initiatives to manage its hardware efficiently.

Business Challenge

Managing retired network gear and business devices at scale posed both operational and financial challenges. AT&T needed to recover value, reduce procurement costs, and ensure obsolete equipment was handled responsibly without slowing ongoing operations or compromising compliance.

The Solution

AT&T implemented a comprehensive IT asset recovery program. Devices with remaining commercial life are refurbished and sold through approved resale partners. Components from non-repairable hardware are harvested to support internal maintenance needs, while remaining materials are sent to certified recycling partners. The program integrates logistics, testing, and secure data wiping into a single workflow.

Results

This approach allows AT&T to reclaim significant value from retired assets while reducing spending on new components. Refurbished devices re-enter circulation quickly, valuable parts support ongoing maintenance, and responsibly recycled materials limit environmental impact, all contributing to more efficient operations and cost savings across multiple departments.

These examples show that when companies treat retired assets as financial resources rather than waste, they can simultaneously drive revenue, reduce operational costs, and mitigate risk.

FAQs

How much are used corporate laptops worth?

In most enterprises, a 2–3-year-old business-grade laptop can still return anywhere from $120 to $450, depending on the model, condition, and storage/CPU configuration.

Devices older than four years tend to drop sharply in value, but they can still generate returns through parts harvesting or certified recycling pathways.

How do I calculate IT asset residual value?

Residual value comes down to four things: age, specifications, condition, and market demand.

How does data wiping work during laptop retrieval and recycling?

Your ITAD provider should perform NIST 800-88 or equivalent data sanitization, verified with audit logs. For storage that can’t be wiped (failed drives), physical destruction is documented. All steps must be tied to a tamper-proof chain of custody.

What’s the best age to retire corporate laptops for maximum resale value?

Most organizations see the highest returns when retiring laptops between 36–48 months. After year four, depreciation accelerates sharply, and even good devices start slipping into low-value categories.

What happens to devices that have no resale value?

When a laptop is too old, too damaged, or too low-spec to be remarketed, it still goes through a structured recovery path. Your ITAD partner typically harvests usable components (storage, screens, RAM), extracts metals, and then pushes the remainder into certified recycling streams.

Leave a Reply