Anyone involved in entrepreneurial activities must know about the Sarbanes and Oxley Act of 2002 in the USA.

Named after Senator Paul Sarbanes and Representative Michael Oxley, the Sarbanes-Oxley Act was enacted in response to the high-profile Enron and WorldCom financial scandals. It was in the best interests of the shareholders and to protect the general public from fraudulent practices in the enterprise. According to the soxlaw website, this law is mandatory for all big or small organizations to comply with.

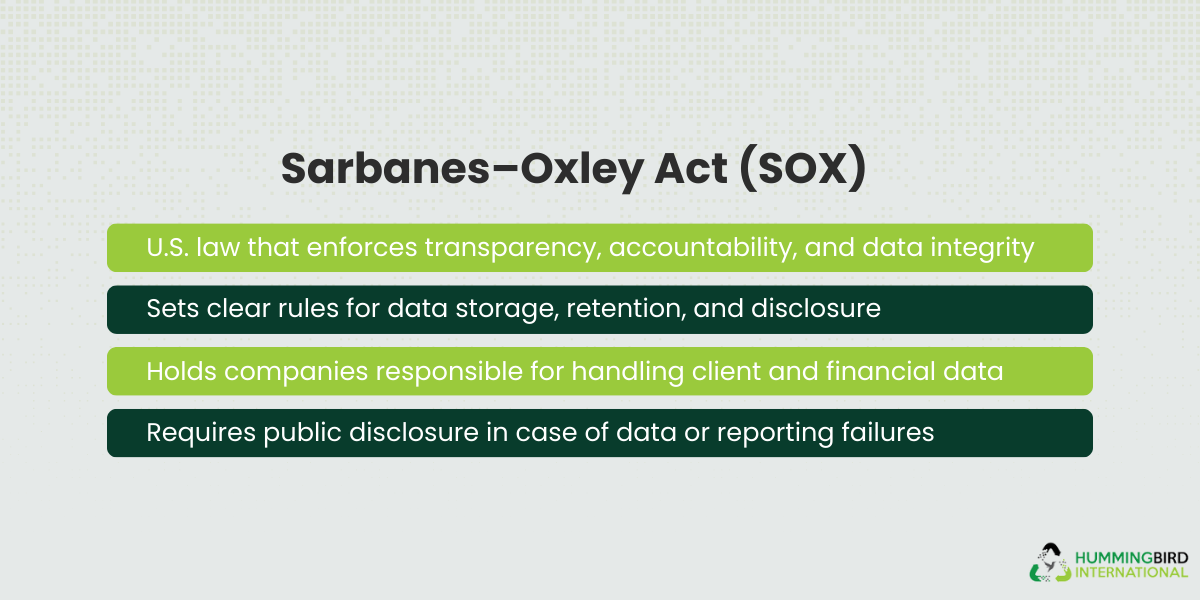

What is Sarbanes-Oxley Act?

The act is responsible to set deadlines and publish rules on requirement. It specifies how a business should store its data and for how long. This act is revolutionary in the sense that it holds companies accountable for clients’ data handling. It also asks them to inform the public in case of a failure.

Because of the Sarbanes and Oxley act, companies now document the full path of their organizational data. This used to be a hazardous task because of the complications and chances of human error in dealing with large volume of complex data, especially, in the cases of merger, acquisition, overhaul, etc. But, now, this legislation defines exactly which record is to be saved and for how long.

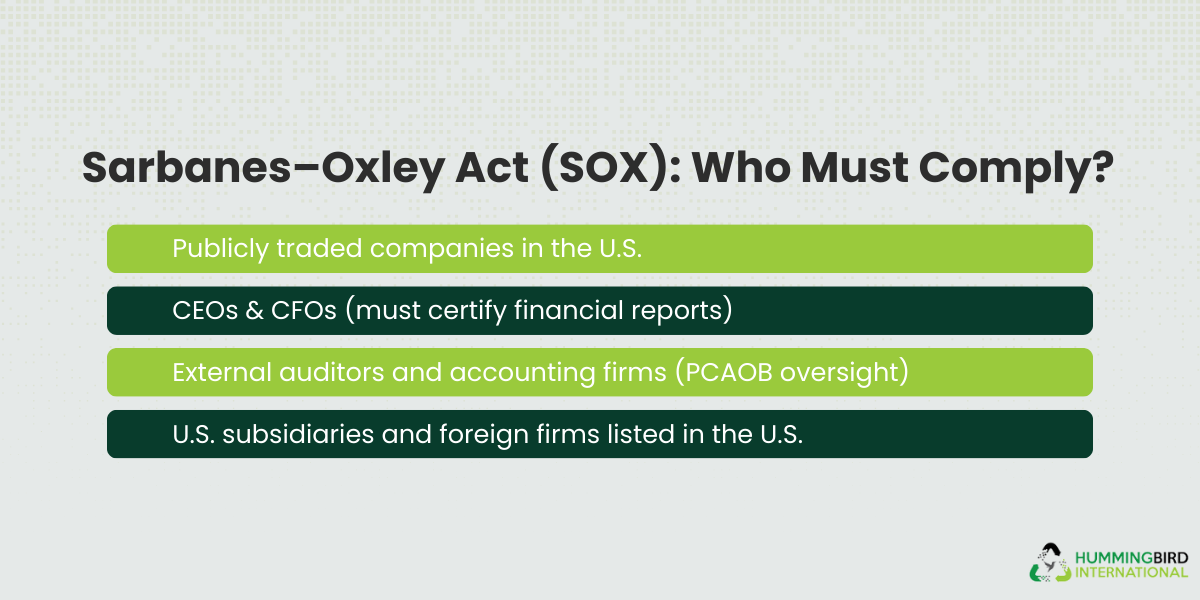

Who is This Act For?

Here are some of the entities that should abide by this act.

Publicly Traded Companies (U.S.)

SOX applies primarily to companies with securities registered in the United States. These companies must meet stringent financial reporting and internal control requirements.

Senior Corporate Executives

CEOs and CFOs must personally certify the accuracy of financial reports filed with the Securities and Exchange Commission (SEC). False certification can trigger criminal penalties.

External Auditors and Accounting Firms

The Act created the Public Company Accounting Oversight Board (PCAOB) to oversee audit firms that examine public companies’ financial statements and internal controls.

Subsidiaries and Foreign Firms

Any subsidiary of a U.S.-listed public company or any international firm with U.S.-listed securities must also comply with SOX requirements

SOX on Certified Data Destruction:

When it comes to storing company records, there is a huge amount of electronic data that comes under question. SOX Act has very clear instructions on that, though.

The Sarbanes-Oxley Act states a minimum time period of five years to save the complete electronic records of an organization, which includes all that was “created, sent, or received in connection with an audit or review and contain conclusions, opinions, analyses, or financial data relating to such an audit or review.”

Non-compliance to the law results in fines or imprisonment. In extreme cases, it may result in both. In order to create a cost-effective corporate records archive, companies make sure that the legislation requirements are met satisfactorily.

Sarbanes-Oxley Act and Hard Drive Disposal

For a corporate company’s financial well-being and security, data destruction is often the most suitable option that is not only cost effective but also brings peace of mind to the business owner that his crucial data won’t land in the wrong hands. Once the hard drive is professionally recycled and data properly disposed, there is no fear of losing important financial details to the wrong people.

The Sarbanes-Oxley Act guidelines favor data destruction in the form of hard drive shredding and tape shredding in order to maintain client privacy. Like all good recycling facilities, Hummingbird International provides excellent hard drive disposal facilities. If you want a sensible, environmental friendly solution, to your e-waste Disposal, then this Philadelphia based computer recycling firm is your ultimate answer.

| Hard Drive Disposal Method | Security Level | SOX Compliance |

|

Hard Drive Shredding |

Very High | Fully Compliant |

|

Tape Shredding |

High | Fully Compliant |

|

Software Wiping |

Medium | Conditional |

|

Physical Storage |

Low | Risky |

Penalties for Non-Compliance

Non-compliance with SOX carries serious legal, financial, and criminal consequences designed to discourage fraud and protect investors.

Criminal Penalties

SOX imposes strict criminal sanctions on individuals who knowingly falsify financial records or certify misleading financial reports:

- Section 906: CEOs/CFOs who knowingly certify materially false financial statements may face up to 10 years in prison and fines up to $1 million; willful violations can lead to up to 20 years and $5 million in fines.

- Section 802: Knowingly altering, destroying, or concealing documents to impede an investigation, audit, or bankruptcy proceeding can result in up to 20 years in prison.

Civil and Regulatory Penalties

The SEC may impose civil fines on corporations and individuals for violations of disclosure and reporting requirements. Penalties can include disgorgement of profits and fines, which vary depending on the severity of the violation.

Reputational and Operational Risks

Beyond fines and jail time, non-compliance can lead to:

- Loss of investor confidence can damage the company’s stock price.

- SEC investigations and enforcement actions.

- Higher audit costs and corrective work can increase operational strain.

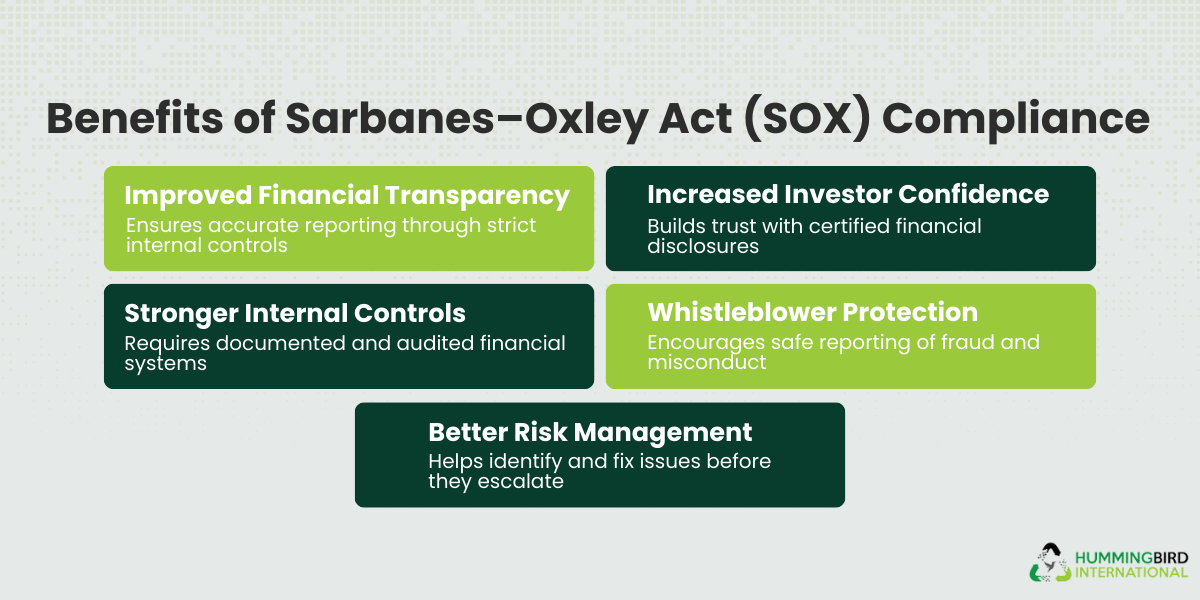

Benefits of Compliance

After talking about what can happen in the case of non-compliance, let’s now look at the positive side and the benefits SOX ensures for improved governance, transparency, and investor trust.

1. Improved Financial Transparency

SOX mandates strict internal controls and documentation for financial reporting, reducing errors and preventing manipulation of financial data. This enhances the accuracy of corporate disclosures.

2. Increased Investor Confidence

By requiring CEOs/CFOs to certify financial reports and enforcing strong audit practices, SOX reassures investors that financial reports are reliable and credible. This helped restore trust in U.S. capital markets after early‑2000s scandals.

3. Stronger Internal Controls

Section 404 requires companies to document, assess, and report the effectiveness of financial controls. External auditors must also attest to these controls, making financial systems more robust.

4. Whistleblower Protection

SOX protects employees who report fraud from retaliation, encouraging early detection of misconduct that might otherwise go unreported.

5. Better Risk Management

Effective SOX compliance leads to improved risk detection and mitigation practices, helping companies identify and resolve weaknesses before they become costly problems.

The Final Word

In conclusion, the Sarbanes-Oxley Act plays a vital role in promoting honesty, accountability, and transparency in businesses. It ensures that companies properly manage, store, and securely destroy financial data while protecting investors and the public from fraud.

Although compliance can require time and effort, it helps build trust, strengthen internal controls, and reduce long-term risks. Ultimately, apart from being a legal obligation, following SOX is a smart step toward responsible, secure business operations.

FAQs

Can digital records be stored outside the United States?

Yes, SOX does not prohibit offshore data storage. However, companies remain fully responsible for accessibility, integrity, auditability, and legal compliance of records, regardless of where the data is physically stored.

What is the difference between data retention and data destruction under SOX?

Data retention focuses on keeping required records intact for a legally mandated period. Data destruction becomes critical after that period expires, ensuring records are securely and irreversibly destroyed to prevent misuse or unauthorized access.

What documentation is required to prove compliant data destruction?

Companies should maintain certificates of destruction, audit logs, chain-of-custody records, and vendor compliance reports. These documents serve as proof during audits or regulatory reviews that data was destroyed properly and lawfully.

What happens if a data breach occurs despite SOX compliance?

SOX compliance does not eliminate the risk of breaches, but it can significantly reduce liability. If a breach occurs, companies must demonstrate due diligence, proper controls, and timely disclosure to regulators and affected stakeholders.

Leave a Reply